Can you imagine transforming your savings into a solid and profitable investment?

What if I told you that you could do it by investing in defaulted mortgage loans?

This type of investment not only offers high returns, but also provides additional protection by being backed by real estate.

In this article, we’ll explore everything you need to know about retail investing in defaulted mortgage loans and how Tokeniza Real Estate facilitates this process through real estate tokenization.

What is the Investment in Defaulted Mortgage Loans?

Investment in non-performing mortgage loans, also known as NPLs (Non-Performing Loans), consists of acquiring loans that borrowers have been unable to repay.

Banks and other financial institutions sell these loans to investors at reduced prices, allowing them to manage their delinquencies and free up resources.

These loans are backed by real estate, which provides additional security to the investor.

Why Invest in Defaulted Mortgage Loans?

- High Yield: Defaulted mortgage loans are sold at significantly reduced prices, allowing for high yields when payments are recovered or the real estate is sold.

- Investment Protection: Backed by real estate, NPLs offer additional protection in case the borrower defaults on payments.

- Diversification: This investment allows you to diversify your portfolio and reduce risks by not relying on a single type of asset.

Real Estate Tokenization: Innovation in the Sector

Tokeniza Real Estate is a platform that allows retail investors to access the market for defaulted mortgage loans through real estate tokenization.

But what exactly is real estate tokenization?

What is Real Estate Tokenization?

Real estate tokenization consists of dividing a real estate asset into small digital tokens, which represent a fraction of the value of the property.

These tokens can be bought and sold by investors in secondary markets, providing greater liquidity and accessibility.

Advantages of Real Estate Tokenization

- Accessibility: Allows retail investors to participate in real estate projects with a minimum investment.

- Liquidity: Tokens can be sold in secondary markets, offering greater flexibility.

- Transparency: Blockchain technology guarantees transparency and security in all transactions.

About Tokeniza Real Estate

About Tokeniza Real Estate

Tokeniza Real Estate is an investment community that uses tokenization and decentralized finance to facilitate access to exclusive real estate projects.

We strictly comply with the Securities Market and Investment Services Law (LMVSI), offering maximum transparency and legal security to the investor.

Our Mission

Our mission is to democratize access to high-return real estate investments by providing a secure and transparent platform for all investors, regardless of their size.

What do we do?

We offer a legal vehicle, in the form of a corporation, to execute real estate projects and share the risk and profit with the Investment Community through Participating Loans.

Our investment securities are negotiable securities in the secondary market, which allows investors to sell their participation at free market price at any time.

Default Mortgage Loan Investment Process

Identification and Analysis

The first step in the NPL investment process is the identification and analysis of defaulted mortgage loans available in the market.

NPL listings are evaluated to identify delinquent situations and assets of interest, using key performance indicators (KPIs) such as auction sale price, debt and the status of the judicial process.

Inspection and Negotiation

Once the NPLs of interest have been identified, a detailed inspection of the status of the judicial process and the occupational status of the asset is carried out.

This ensures that it has the legal right to execute the sale in favor of a third party without taking possession of the property.

Subsequently, negotiations are held with the owners of the properties to find an agreed solution to the situation of mortgage arrears, either through the purchase of the debt by a family member, dation in payment or handing over the keys.

Purchase and Recovery

Once negotiations are completed, the identified mortgage is purchased.

Tokeniza Real Estate works closely with financial institutions and funds to acquire the mortgages at a price that allows the target return agreed with the investors to be achieved.

The recovery of the loan is done through the sale of the secured property at auction, ensuring maximizing profitability and minimizing sale terms and transaction risks.

Non-Performing Loan (NPLs) Market

The non-performing loan market is a global financial sector in which financial institutions sell loans that borrowers have been unable to repay.

This market is of significant size, with a value of €76 billion in Spain in 2023.

Approximately 30% of this market is made up of non-performing mortgage loans (Secured NPLs), representing a considerable opportunity for investors.

Operation of the NPL Market

Financial institutions package thousands of unpaid mortgage loans (portfolios) in order to sell them.

These portfolios are auctioned and acquired by national and international funds, which then subcontract servicers to manage the recovery of the defaults.

These servicers are in charge of maximizing the recovery of the amount paid for the portfolio.

Why Invest in Mortgage NPLs?

Investing in defaulted mortgage NPLs allows to obtain high profitability, also counting on the high “downside protection” of the investment, since the value of the property acts as collateral for the defaulted loan.

Tokeniza Real Estate allows retail investors to participate in this market with a minimum investment of 600 euros.

Profitability and Comparison with Other Financial Products

Projected Profitability

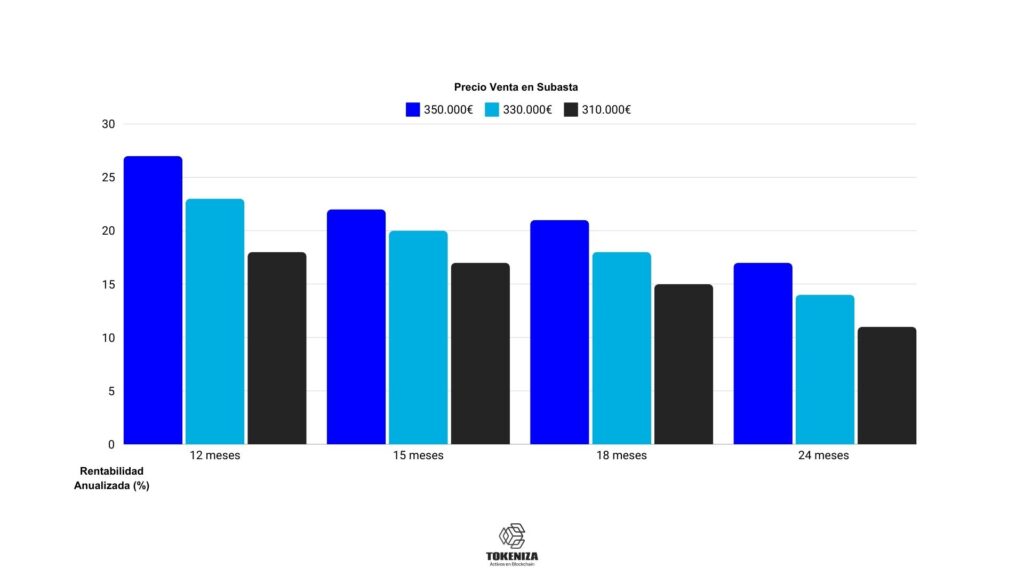

The projected annualized return on our NPLs is one of the main attractions for investors.

Depending on the auction sale price and payback period, returns can vary considerably, offering a significant passive income opportunity.

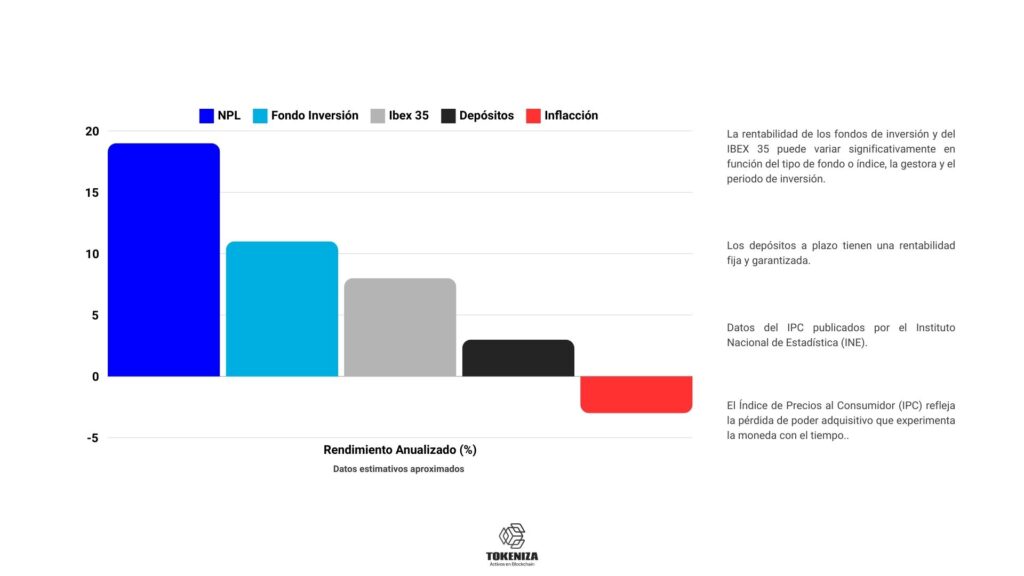

Comparison with Other Financial Products

Compared to other financial products such as mutual funds, IBEX 35 or time deposits, investing in defaulted mortgage NPLs offers a potentially higher return, although it also carries certain risks.

It is important to assess these risks and understand the market dynamics before investing.

Frequently Asked Questions

What is the minimum investment in our Non-Performing Mortgage Loans (NPLs)?

You can start by investing a minimum amount of 600 euros.

Are there upfront costs in the NPL001 investment?

Investing in Tokeniza does not involve upfront costs such as opening fees or insurance.

If you buy the digitized security on blockchain, you will have to pay for the Ethereum network gas.

When do the returns on my investment begin?

Interest begins to accrue when the total collection of funds is reached.

What happens if I need to recover my investment?

You can sell your stake to another investor.

We are working on a liquidity reserve to automate the secondary market; at the moment, a buyer is required to sell your investment securities.

What happens if the funds are not raised?

All investors will receive a full refund of the amounts contributed.

What is the Investor Service like?

We offer continuous support and information from Monday to Friday, from 9:00 to 18:00 CET, through the digital platform, Telegram and WhatsApp channels, email and telephone.

What assistance is offered to investors unfamiliar with Blockchain technology?

We offer support for the setup and use of the web wallet3 (Metamask).

In addition, investors can choose to invest and receive returns in Euros.

Conclusion

Investing in defaulted mortgage loans through Tokeniza Real Estate offers a unique opportunity for retail investors.

With an affordable minimum investment, high projected returns and the added security of being backed by real estate, this form of investment can transform your savings into significant passive income.

Real estate tokenization facilitates access to this market, providing transparency, liquidity and security.

If you are looking for an innovative and profitable way to invest your savings, consider investing in defaulted mortgage loans with Tokeniza Real Estate.

Find out more on our platform and start transforming your savings today!

Want to know if you can invest in our NPLs?

Fill in the form and download our detailed investor guide.